Maintaining the trend from October, all eight significant market segments saw seasonally readjusted rates that were reduced year over year in the initial half of November.Graphic: Cox Automotive Wholesale used-vehicle costs(on a mix-, gas mileage-, and also seasonally readjusted basis)increased 0.4% from October in the first 15

days of November, according to the mid-month Manheim Used Vehicle Value Index launched Nov. 17, which rose to 200.7. That was down 13.7%from November 2021. The non-adjusted rate modification in the initial fifty percent of November declined 0.8%compared to October, relocating the unadjusted typical cost down 11.7 %year over year. Over the last 2 weeks, Manheim Market Report (MMR) rates saw fairly normal decreases for the time of year, leading to a 1.1% collective decline in the Three-Year-Old MMR Index, which stands for the biggest model-year friend at auction. Throughout the initial 15 days of November, MMR Retention, which is the ordinary distinction in price relative to present MMR, averaged 98.4%, which indicates that assessment designs are ahead of market prices.The ordinary

everyday sales conversion price of 50.7% in the initial fifty percent of November declined about October's everyday standard of 51.3%. Still, conversion prices usually decline in November, and also the conversion price resembled the daily standard in November 2019. The most recent trends in key signs suggest wholesale used-vehicle values should decrease in accordance with regular fads in the second fifty percent of November.Maintaining the trend from October, all eight significant market sectors saw seasonally readjusted prices that were lower year over year in the initial half of November. Small cars had the lowest decrease at -9.5%, while sports cars, vans, pick-ups and midsize cars shed less compared to the total industry in seasonally changed year-over-year changes. Contrasted to October, 5 significant sections saw cost boosts, with full-size, luxury as well as midsize automobiles less than the industry. Just cars and vans revealed unadjusted cost increases versus October.Retail and Wholesale Days'Supply Normal in Mid-November Utilizing quotes based on vAuto data since Nov. 14, used retail days'supply was 49 days, which was down 2 days from the end of October. Days'supply was up seven days year over year yet despite the exact same week in 2019. Leveraging Manheim sales as well as supply data, Cox estimates that wholesale supply will end November at 28 days, the same from the end of October yet up eight days year over year. Since Nov. 15, wholesale supply went to 28 days, the same from completion of October but up seven days yersus year over year and also one day lower than at the exact same time in 2019. Used supply determined in days 'supply and also contrasted to 2019 recommends supply is normal for this time around of year, which shows that devaluation ought to be typical for the time of year as well.Rental Risk Prices Mixed, Mileage Down in First Two Weeks of November The average price for rental threat devices sold at auction in the very first 15 days of November was up 1.5 %year over year

. Rental danger costs were down 0.3%compared to the full month of October.

Average mileage for rental threat units in the first half of October (at 55,400 miles )was down 26.8 %compared to a year earlier as well as down 2.9%month over month.Consumer Sentiment Measures Mixed to Start November The initial October reading on Consumer Sentiment from the University of Michigan decreased 8.7 %to 54.7 as sights of existing conditions fell much more, and also future expectations also

decreased. Expected rising cost of living prices boosted a little

. Consumers' views of acquiring problems for vehicles decreased however was still the second-best analysis since March. June was the all-time low in the analysis. The day-to-day index of consumer belief from Morning Consult reflects that view is trending higher to start the month. The timelier procedure suggested customer belief was up 2.3 %in the first 15 days of November. This reduced action coincided with declining gas costs in early November, an improving securities market and also a fairly calm mid-term political election. Originally posted on Vehicle Remarketing

For GREAT deals on a new or used Chrysler, Dodge, Jeep or RAM check out Bravo CDJR TODAY!

He added:"Pauline has been at my side for a lot of my occupation and also has actually been by (current Chorley Group managing director

He added:"Pauline has been at my side for a lot of my occupation and also has actually been by (current Chorley Group managing director SMMT chief executive Mike Hawes stated:"The UK's van market continues to be bound by supply lacks in the middle of tough operating problems, which will likely continue into 2023, easing over the course of the year.

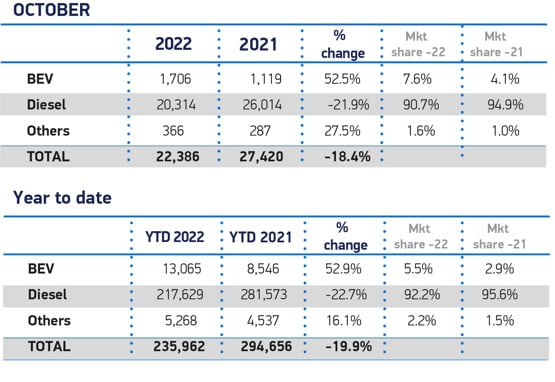

SMMT chief executive Mike Hawes stated:"The UK's van market continues to be bound by supply lacks in the middle of tough operating problems, which will likely continue into 2023, easing over the course of the year. In the van market, battery electric car (BEV) climbed 52.5 %year-on-year in October to represent 7.6% of the market-- up from 4.1% in the very same month in 2014.

In the van market, battery electric car (BEV) climbed 52.5 %year-on-year in October to represent 7.6% of the market-- up from 4.1% in the very same month in 2014. Despite falling behind Ford-- up 1.9%year-to-date-- Volkswagen expanded its October enrollments by 41.5%, to 12,804 units, in October yet continues to be 19.5% down year-to-date.

Despite falling behind Ford-- up 1.9%year-to-date-- Volkswagen expanded its October enrollments by 41.5%, to 12,804 units, in October yet continues to be 19.5% down year-to-date. The opening, its first within the VWCV franchise, represents one of a series of growth opportunities completed by the group during 2022, with more to come in 2023.

The opening, its first within the VWCV franchise, represents one of a series of growth opportunities completed by the group during 2022, with more to come in 2023.